Banks urged to expand loan products for private companies

China's financial institutions should include more medium to long-term loan products, in order to help the country's private companies access investment easily, said Ye Qing, vice-president of All-China Federation of Industry and Commerce.

"For small and micro businesses, banks should enhance their guidance on giving loans, in order to solve the problem of information asymmetry," said Ye, who is also a member of the National Committee of the Chinese People's Political Consultative Conference.

He added that as the business environment varies in regions, major State-owned banks should offer loan products based on local conditions, to provide private enterprises with more choices.

"Some private enterprises face a problem of getting capital; however, the problem also comes from the enterprises themselves, whether they have met the standard of the financial institutions. They should think a way out," Ye said.

- Sino-foreign youth dialogue promotes mutual understanding in Nanning

- Surfing in Guangdong's Shantou

- Macao SAR to speed up reform, diversification in 2026: chief executive

- China's primary school population peaks, middle school to follow

- China's express delivery sector posts steady growth in first 10 months

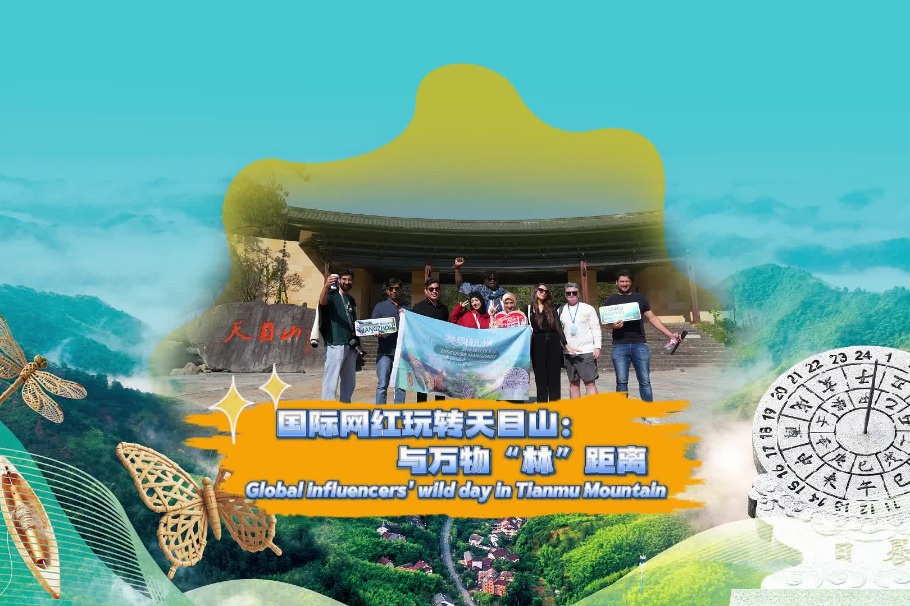

- Intl visitors embrace nature, biodiversity at Tianmu Mountain