Financial health underlined for inclusive finance development

China is placing greater emphasis on financial health as the next stage of its inclusive finance agenda, shifting the focus from simply broadening access to improving the quality, depth and durability of financial services for households and small businesses.

This shift was highlighted with the release of an inclusive finance white paper jointly launched on Tuesday in Beijing by CICC Wealth Management and the Chinese Academy of Financial Inclusion (CAFI).

Bei Duoguang, president of the academy, said China's inclusive finance has entered a new phase where the focus is no longer on the mere existence of services, but on whether they truly meet public needs.

"Inclusive finance in China is now transitioning from the phase of whether we have it, to whether it is good."

Financial health — the ability of households to withstand shocks, plan ahead, manage risks and accumulate assets — has been a key global measure of inclusive finance quality. Bei stressed that inclusive finance should not be narrowly defined as serving only low-income groups. "Inclusive finance refers to the inclusiveness of the entire financial system. Insurance, credit, wealth management and capital markets all align with this direction," Bei said.

He added that China's financial structure is gradually shifting away from a "credit-heavy, selective financing" model toward a more balanced framework in which capital markets play a larger role.

According to the white paper, nearly 70 percent of surveyed residents show relatively good levels of financial health, though gaps remain in financial control, long-term planning and risk preparedness — especially for small business owners managing both household and corporate finances. The study also points to rising demand for simple, low-entry investment tools among mass-market users.

Industry practitioners said technological advances have made it possible to create large-scale, low-cost products suitable for investors who are just starting out. CICC Wealth Management's 1,000 yuan ($141) entry-level investment option, for example, was cited as a practical case of how small-ticket, rules-based products can broaden financial participation without adding complexity.

Experts stressed that long-term investment and risk management should be considered essential elements of inclusive finance, rather than extensions of traditional credit services.

Ji Min, an official at the People's Bank of China, the central bank, said participation in capital markets is crucial for financial literacy. "Only when you participate in the capital market do you understand market volatility and learn to avoid believing in unrealistic promises of high, stable returns," he said, adding that "most retail investors have not generated sustained earnings from the equity market", and warning that improving investment outcomes is key to building a more inclusive capital market.

Ji called for measures such as stronger tax incentives for pension finance, more flexible liquidity arrangements for long-duration products and expanding residents' property income through securitization and the activation of existing assets.

China has in recent years issued a series of policies encouraging financial institutions to support small and micro enterprises, enhance household asset diversification and deepen multi-tiered capital markets. Analysts say these moves reflect a shift toward financial services that put greater weight on sustainability, risk awareness and long-term value creation.

Yang Tao, deputy director of the National Institution for Finance and Development, said the white paper enriches the understanding of inclusive finance by linking it to wealth management. "Research that links inclusive finance and wealth management is still quite rare," he said.

He added that improving financial health on the demand side must go hand-in-hand with strengthening the supply of suitable products and services.

CICC Wealth Management said it is expanding access to high-quality underlying assets, such as ETFs and index funds, while digital advisory systems translate professional asset-allocation logic into everyday investment tools. These approaches aim to help mass-market clients cultivate long-term, disciplined investment habits.

For small businesses, the company offers support through its "CICC Jinhe" system, which helps enterprises strengthen financial management and access relevant resources. Financial-health self-assessment tools jointly developed with CAFI also enable residents to better understand their financial resilience and identify areas for improvement.

Wang Jianli, member of the CICC Management Committee and president of CICC Wealth Management, said, "CICC Wealth Management will channel the flow of inclusive finance to where it is most needed, injecting inclusive, healthy and sustainable financial momentum into Chinese modernization."

Today's Top News

- CPC holds symposium to commemorate 110th birth anniversary of Hu Yaobang

- Economy seen on steady track

- Trade-in program likely to continue next year

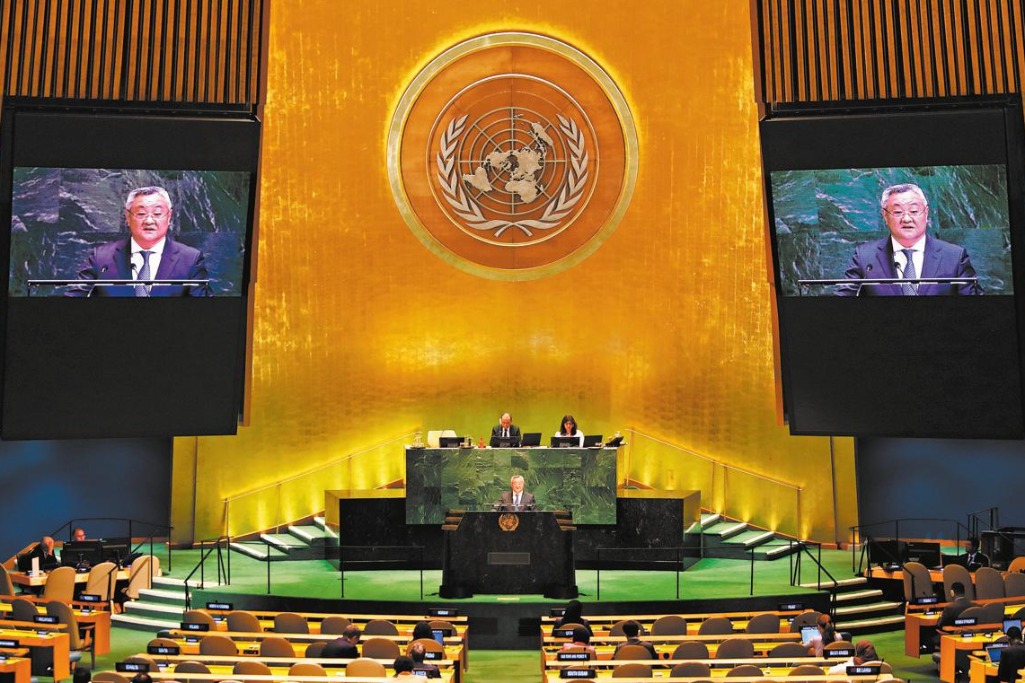

- Li: SCO can play bigger role in governance

- Huangyan Island protection lifeline for coral ecosystem

- Latin America urgently needs green credit