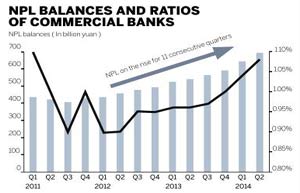

BEIJING - The ratio of non-performing loans for commercial banks in China climbed to 1.16 percent by the end of September, up 0.09 percentage points from the end of June, the latest official data showed on Saturday.

By the end of September, non-performing loans in the banking sector stood at 766.9 billion yuan ($124.9 billion), 72.5 billion yuan more than the previous quarter, according to a report released by the China Banking Regulatory Commission.

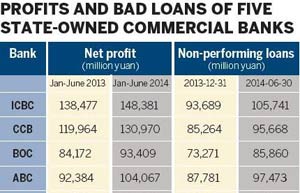

Earlier data showed the non-performing loan ratios for the nation's five biggest banks, including Industrial and Commercial Bank of China (ICBC), Agricultural Bank of China, Bank of China, China Construction Bank, and Bank of Communications stood at 1.06 percent, 1.29 percent, 1.07 percent, 1.13 percent, and 1.17 percent, respectively.

Despite the rising trend, the regulator said the banks' capacity to offset risks was "relatively strong" and their credit and asset quality is "generally within control".

By the end of September, the average capital adequacy ratio of Chinese banks came in at 12.93 percent, up 0.53 percentage points from the end of June.

|

|

|

|

|